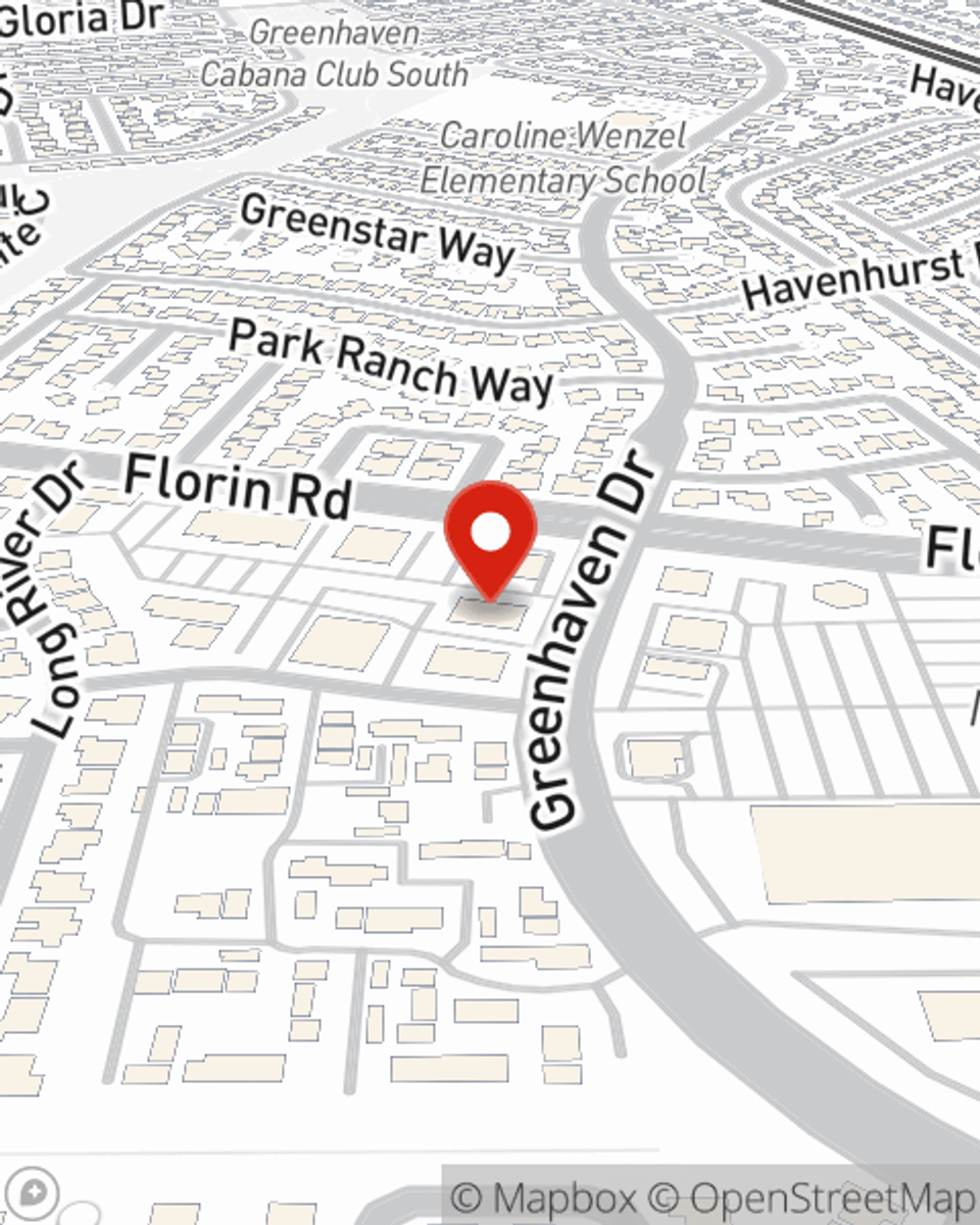

Business Insurance in and around Sacramento

Looking for small business insurance coverage?

This small business insurance is not risky

Business Insurance At A Great Value!

Whether you own a a pharmacy, a bakery, or an art gallery, State Farm has small business protection that can help. That way, amid all the various moving pieces and options, you can focus on navigating the ups and downs of being a business owner.

Looking for small business insurance coverage?

This small business insurance is not risky

Insurance Designed For Small Business

When one is as dedicated to their small business as you are, it is understandable to want to make sure everything is in order. That's why State Farm has coverage options for artisan and service contractors, commercial liability umbrella policies, worker’s compensation, and more.

The right coverages can help keep your business safe. Consider reaching out to State Farm agent Bob Smith's office today to learn about your options and get started!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Bob Smith

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.